Markets Test Resilience Amid Global Headwinds and Policy Uncertainty

Global markets closed the week on a cautious tone as a series of political, economic, and corporate developments introduced new layers of uncertainty. From Tesla’s record-breaking compensation approval to growing strains in U.S. air travel and signs of weakening Chinese trade, investors are reassessing risk appetite heading into the final stretch of the year. Volatility remains elevated as the U.S. government shutdown disrupts key data flows, complicating monetary policy expectations and investor positioning.

Global Equities: Momentum Stalls After AI-Led Rally

Stocks struggled to find direction on Friday, with U.S. futures showing little movement following a volatile week that halted the year’s artificial intelligence–driven rally. The S&P 500 was down nearly 1.8% for the week, while Nasdaq 100 futures also hovered near unchanged levels.

Dip-buying efforts faded quickly as traders grappled with the impact of the prolonged U.S. government shutdown, which has limited access to economic data and fueled speculation about delayed Federal Reserve actions. Despite near-term uncertainty, market participants still see strong fundamentals underpinned by robust earnings and expectations of eventual policy easing.

Commodity markets reflected mixed sentiment: gold extended gains above $4,000 per ounce amid safe-haven flows, while Brent crude rose 1.3% to $64.23 a barrel. The 10-year U.S. Treasury yield climbed slightly to 4.11%, highlighting continued caution in fixed income.

Tesla Shareholders Approve $1 Trillion Pay Package

In a landmark corporate event, Tesla shareholders voted overwhelmingly to approve a $1 trillion compensation plan for CEO Elon Musk — the largest in history. The decision followed an extensive campaign by Tesla’s board to secure investor backing after previous court challenges to Musk’s pay structure.

The package ties Musk’s compensation to ambitious performance targets, including expanding Tesla’s market capitalization to $8.5 trillion and scaling production of its next-generation projects such as the robotaxi and Optimus humanoid robots. Musk hinted that Tesla may build its own chip fabrication facility, dubbed a “Terafab,” to meet long-term production needs.

Tesla shares rose modestly in after-hours trading following the vote. The approval secures Musk’s leadership position for the coming decade, aligning his control with Tesla’s push into autonomous technologies and artificial intelligence development. However, the vote also reignited debates about corporate governance and wealth concentration amid growing inequality concerns.

U.S. Aviation Sector Hit by Shutdown-Driven Flight Cuts

The ongoing U.S. government shutdown continues to weigh heavily on air travel and infrastructure operations. The Federal Aviation Administration (FAA) has ordered airlines to cut 10% of flight capacity across 40 major airports starting this week to mitigate staffing shortages and safety risks.

Major carriers — including United, American, Delta, and Southwest — began canceling hundreds of domestic flights daily, focusing on less crowded regional routes. The disruption comes as the holiday season approaches, threatening to impact millions of passengers and strain the U.S. transportation system.

Over 13,000 air traffic controllers are currently working without pay, contributing to increased fatigue and absenteeism. Lawmakers have demanded transparency on the FAA’s risk assessment, while analysts warn that extended disruptions could slow U.S. travel demand and dent fourth-quarter GDP growth.

China’s Export Momentum Weakens as U.S. Demand Collapses

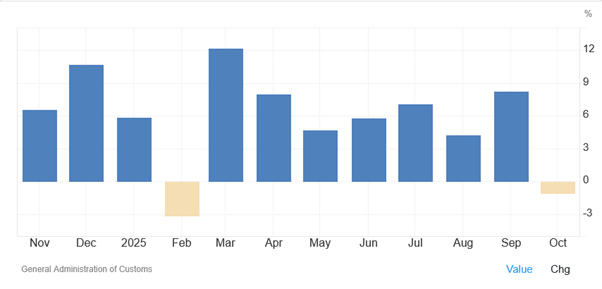

China’s October trade figures revealed a surprise contraction in exports — the first decline since February — signaling renewed fragility in the world’s second-largest economy. Outbound shipments fell 1.1% year-over-year, dragged by a steep 25% plunge in exports to the United States.

While exports to other markets rose modestly, they failed to offset the U.S. decline, reflecting the persistent impact of trade tensions and a stronger yuan. Shipments to the European Union grew just 1%, the weakest pace since early 2023, and sales to South Korea, Russia, and Canada also fell sharply.

Although Beijing and Washington recently agreed to reduce certain tariffs by 10%, economists expect limited benefits as overall trade barriers remain high. The export weakness comes amid ongoing challenges in China’s property sector and subdued domestic demand, raising concerns that growth could slip to its slowest rate since late 2022.

Nevertheless, China’s trade surplus remains elevated at $965 billion for the year, underscoring structural imbalances between weak consumption and resilient industrial output.

Market Outlook

The convergence of political risk, economic slowdown, and shifting global trade patterns is setting the stage for heightened volatility into year-end. Investors are awaiting signals of policy coordination, particularly in the U.S. where the shutdown has obscured key macro data.

In the short term, risk assets may continue to trade in narrow ranges until clarity emerges on U.S. fiscal negotiations and China’s next stimulus steps. Longer term, opportunities may reappear in sectors linked to AI, automation, and green technology — areas where capital investment remains robust despite cyclical uncertainty.

Prepared by Nour Hammoury, Chief Market Analyst at SquaredFinancial

Nour is an investor, independent market strategist, and financial advisor. He holds a BA in Finance and Banking Science from Al-Ahliyya Amman University and a CFTe in Economics from the International Federation of Technical Analysts. He has more than 15 years of experience in forex, stocks, and global economic developments, as well as central bank policies and intermarket analysis. He appears regularly on major international TV networks, such as BBC, Al-Jazeera, Al Hurra, CNBC, and Bloomberg, holding open discussions and sharing insights and readings of the markets and trends.

Disclaimer

This is a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. The information contained herein does not constitute a personal recommendation and does not consider your personal investment objectives, investment strategies, financial situation or needs. Squared Financial makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on a recommendation, forecast, or other information supplied by Squared Financial.