Global markets edge lower as tariff tensions escalate and Bitcoin breaks records

Markets opened the week on a cautious note as renewed trade tensions led by the United States weighed on investor sentiment. With equity futures drifting lower and geopolitical uncertainty rising, traders are closely watching upcoming economic data and earnings season for further direction. Meanwhile, Bitcoin broke above $120,000, and China posted stronger export data, offering some divergence in the global economic landscape.

US tariffs spark broad-based market caution

Global equity markets saw modest declines after President Trump announced a 30% tariff on imports from the European Union and Mexico. This surprise escalation came despite earlier signs of ongoing negotiations between the US and its major trading partners. S&P 500 futures dipped 0.4%, while European equity futures dropped 0.6%. Asia remained relatively flat, with small gains in Hong Kong and Shanghai.

The tariffs mark a fresh round of protectionist moves targeting multiple regions, undermining the recent optimism around global trade talks. While some investors continue to assume that Trump may soften his stance before implementation, others are starting to price in more lasting damage to global trade flows and confidence.

EU responds with wider engagement and possible retaliation

In reaction to the new US tariffs, the European Union has initiated discussions with countries such as Canada and Japan to explore joint strategies. The bloc aims to deepen trade ties with Asia-Pacific economies, including India, where a trade deal is expected by year-end.

The EU has extended its suspension of countermeasures against the US until August 1 to allow for last-minute negotiations. However, Brussels is preparing an expanded list of retaliatory tariffs covering up to €72 billion in US goods and export controls, should talks fail.

European leaders are urging a united front, with Germany’s Chancellor warning of severe impacts on the continent’s largest exporters. French President Macron has also pushed for faster preparations for counteraction. Despite the strong language, the EU is still holding back on deploying its anti-coercion trade tool, reserving it for what it calls “extraordinary situations.”

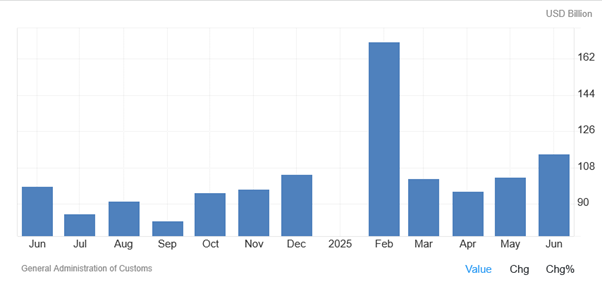

China’s export momentum surprises to the upside

In a rare bright spot for global trade, China’s export growth accelerated in June, rising 5.8% year-on-year to $325 billion. This marked the first uptick since March and came in above expectations. Imports also returned to growth, lifting the trade surplus to $115 billion for the month.

The improvement was driven by easing US tariffs—now down to 55% from a peak of 145% in April—and steady demand from major overseas markets. However, officials in Beijing warned that rising global protectionism and more complex external risks could weigh on trade in the second half of the year.

New tariff structures between the US and Vietnam, particularly aimed at transshipped goods, could also disrupt Chinese supply chains. China’s trade resilience so far this year has helped offset weak domestic demand, keeping GDP growth close to the government’s 5% target.

Bitcoin surges beyond $120,000, silver shines

Bitcoin crossed $120,000 for the first time, gaining 1.4% and reflecting continued enthusiasm among investors looking for alternative assets amid geopolitical and monetary uncertainty. Ether also rose 1.5%, climbing above $3,030.

Precious metals are benefiting from the cautious tone in markets. Silver, in particular, is trading near its highest level since 2011, supported by both safe-haven flows and industrial demand. Spot gold was little changed, holding above $2,400 per ounce.

Central bank spotlight: BOJ and Fed

In Japan, the yen gained slightly as reports suggested that the Bank of Japan may revise inflation forecasts upward at its next meeting. The 10-year Japanese government bond yield climbed five basis points to 1.55%.

Meanwhile, pressure is mounting on the US Federal Reserve. President Trump and several administration officials have stepped up criticism of Fed Chair Jerome Powell over the cost of the central bank’s headquarters renovation. There are growing whispers in Washington of a push to remove Powell, a move that, if attempted, could spark major volatility in the dollar and Treasuries.

What to watch this week

- China GDP and Industrial Production

- US and Eurozone CPI Data

- Start of Q2 Earnings Season

Markets will be sensitive to any surprises in inflation data and company results as they gauge recession risks, central bank direction, and the impact of higher tariffs on corporate margins.

With escalating trade tensions and shifting central bank dynamics, volatility is likely to remain elevated. Traders should stay nimble and focused on high-impact data and geopolitical developments that could reshape the outlook for Q3 and beyond.

Prepared by Nour Hammoury, Chief Market Strategist at SquaredFinancial

Nour is an investor, independent market strategist, and financial advisor. He holds a BA in Finance and Banking Science from Al-Ahliyya Amman University and a CFTe in Economics from the International Federation of Technical Analysts. He has more than 15 years of experience in forex, stocks, and global economic developments, as well as central bank policies and intermarket analysis. He appears regularly on major international TV networks, such as BBC, Al-Jazeera, Al Hurra, CNBC, and Bloomberg, holding open discussions and sharing insights and readings of the markets and trends.

Disclaimer

This is a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. The information contained herein does not constitute a personal recommendation and does not consider your personal investment objectives, investment strategies, financial situation or needs. Squared Financial makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on a recommendation, forecast, or other information supplied by Squared Financial.

The information on this site is not intended for any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.