Global growth warnings and political turbulence weigh on sentiment

Markets are starting the week under considerable strain as concerns over global economic growth, monetary policy flexibility, and rising geopolitical frictions weigh on sentiment. A wave of negative headlines, from the OECD’s downgraded global forecast to central banks grappling with shifting inflation dynamics and growing political fractures in Europe and Asia, has cast a cautious tone across asset classes. Investors are recalibrating expectations amid renewed volatility across stocks, rates, currencies, and commodities.

Global growth outlook slashed by OECD

World Full Year GDP Growth

The OECD revised down its global growth forecast to 2.9% for 2025, from a previous estimate of 3.3%, citing trade disruptions as a core risk — with the U.S. taking the brunt of the impact due to ongoing trade friction with China. This marks the weakest outlook since the pandemic.

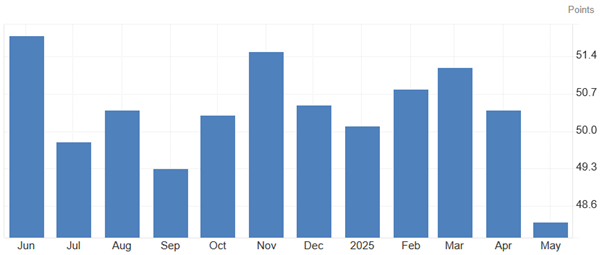

China Manufacturing PMI

- China’s manufacturing PMI dropped sharply to 48.3, reflecting contraction and defying all estimates.

- Lingering tensions between Washington and Beijing remain unresolved, despite tentative plans for a high-level call between the two presidents.

- Export control disputes over rare earth materials and semiconductor restrictions continue to escalate.

UK rate outlook adjusts amid softening data

BOE Interest Rate Expectation

Bank of England Governor Andrew Bailey indicated a potential shift from the current cautious rate-cut path if inflation risks undershoot the 2% target. While the central bank remains in a gradual cutting mode, Bailey signaled readiness for more aggressive easing if growth and wage pressures deteriorate.

- Markets still expect one more cut this year, but forward guidance remains conditional on labor data and inflation persistence.

- The labor market has loosened, and wage expectations are cooling, reinforcing the possibility of future flexibility.

US trade policy and tariff risks return to spotlight

Former President Trump’s revived trade rhetoric — including threats of retaliatory tariffs against trading partners — is reigniting concerns across global markets.

- The White House is pressing China on lifting export restrictions, while Beijing accuses the US of violating recent agreements.

- Trump’s proposed “revenge tariff” system is raising fears of fresh trade wars, further pressuring global supply chains.

Political volatility builds in Europe

- The Dutch government collapsed after Geert Wilders’ far-right party exited the ruling coalition over immigration disputes. A snap election has been triggered, injecting uncertainty into European political stability.

- In South Korea, a pivotal presidential election follows a period of constitutional crisis and martial law debates, with trade tensions central to economic recovery prospects.

China-EU tensions worsen over medical procurement

The EU’s decision to restrict Chinese medical device companies from public tenders has been met with strong objections from Beijing. The move may further deteriorate EU-China relations, especially at a time when Beijing is trying to position itself as a more stable trade partner amid US decoupling.

Corporate highlights and sector risks

- Adani Group shares dropped after reports surfaced about potential sanctions violations involving Iran-linked shipping routes.

- Toyota Industries is considering a ¥6 trillion buyout to strengthen family control, signaling shifts in Japan’s corporate governance dynamics.

- New World Development faces mounting risks on its $2.6B mega-mall project in Hong Kong due to tenant delays and weak consumer sentiment.

Investor caution evident across markets

- Bond yields climbed modestly, with the US 10Y yield edging up to 4.44%, reflecting expectations of stickier inflation and tighter policy.

- Risk aversion remains high, pushing gold prices higher and pressuring emerging market currencies.

- Equities sold off broadly, with US futures and European indices posting notable declines as risk appetite deteriorated.

Prepared by Nour Hammoury, Chief Market Analyst at SquaredFinancial

Nour is an investor, independent market strategist, and financial advisor. He holds a BA in Finance and Banking Science from Al-Ahliyya Amman University and a CFTe in Economics from the International Federation of Technical Analysts. He has more than 15 years of experience in forex, stocks, and global economic developments, as well as central bank policies and intermarket analysis. He appears regularly on major international TV networks, such as BBC, Al-Jazeera, Al Hurra, CNBC, and Bloomberg, holding open discussions and sharing insights and readings of the markets and trends.

Disclaimer

This is a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. The information contained herein does not constitute a personal recommendation and does not consider your personal investment objectives, investment strategies, financial situation or needs. Squared Financial makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on a recommendation, forecast, or other information supplied by Squared Financial.

The information on this site is not intended for any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.