FOMC minutes in focus, tech slide, UK inflation surprise, political risks

Global markets opened today under pressure, with investors balancing expectations for US monetary policy against weak corporate earnings, political turbulence, and inflation surprises abroad. The release of the Federal Reserve’s July meeting minutes will dominate today’s agenda, providing critical insight into the trajectory of interest rate cuts. Meanwhile, a sharp selloff in US technology stocks and persistent UK inflation highlight the fragile global backdrop. Political developments in Washington are adding further uncertainty to Fed independence.

United States: FOMC minutes & market setup

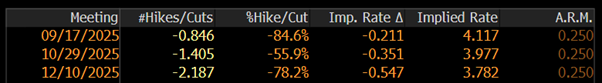

The Federal Reserve’s July meeting minutes are due later today and will guide expectations ahead of the September 17 FOMC decision. Traders currently see an 83% probability of a quarter-point rate cut, down from near certainty before recent hot inflation and resilient economic data. Some still price in the possibility of a third cut by year-end.

Attention will quickly shift to Chair Jerome Powell’s Jackson Hole speech on Friday, where markets expect clarification on whether easing will be front-loaded or gradual. Powell has used the symposium in past years to reset market expectations, so investors are cautious heading into the event.

US equities: Tech selloff & earnings movers

Wall Street is enduring a fourth consecutive session of losses, led by technology shares. Contracts on the Nasdaq 100 fell 0.3%, extending the pullback in the “Magnificent Seven.” Nvidia steadied but remains under pressure ahead of earnings, while Tesla and other AI-linked names declined.

Corporate earnings further weighed on sentiment.

- Target plunged more than 10% despite beating earnings expectations, after announcing a leadership change and weak sales trends.

- Estee Lauder tumbled 8% after issuing a downbeat profit outlook, citing tariff costs.

- Palantir slid another 3%, extending its losing streak to six sessions.

The broader S&P 500 slipped 0.1%, reflecting profit-taking after a record-breaking rally earlier this month.

UK: Inflation jumps to 18-month high

UK inflation unexpectedly accelerated to 3.8% in July, the fastest pace since January 2024, driven by food, transport, and hospitality costs. Services inflation, a key gauge for policymakers, rose to 5%, exceeding the Bank of England’s forecast.

The increase intensifies the debate within the BOE, which cut rates earlier this month to 4%. While markets still see a 40–45% chance of another cut by year-end, sticky price pressures may limit the pace of easing. Policymakers face a delicate balance between supporting a fragile economy and preventing second-round wage and price effects.

The political backdrop adds further complexity, with Chancellor Reeves’ tax and wage hikes seen as fueling cost pressures, while Prime Minister Starmer faces rising criticism as real incomes weaken.

Political risk: Trump pressures the Fed

US politics re-entered the monetary policy debate after President Trump called for Fed Governor Lisa Cook’s resignation. The move follows allegations of mortgage irregularities raised by Trump ally and FHFA Director Bill Pulte.

While no charges have been filed, the referral intensifies Trump’s campaign to reshape the Fed board. An early resignation would give him another opportunity to appoint a dovish policymaker ahead of Powell’s term expiring in May. Markets view this as an attempt to pressure the Fed into more aggressive rate cuts.

Market snapshot

US Yields: 10-year Treasury steady at ~4.30%

Oil: WTI crude around $63.1, Brent near $66.5 a barrel

Gold: Higher at $3,337/oz as investors hedge risk

Currencies: Dollar little changed; pound flat at $1.35 after inflation report

Crypto: Bitcoin modestly higher at $113,700

Markets enter the second half of the week on fragile footing. The Fed minutes and Powell’s Jackson Hole speech are likely to set the tone for global risk sentiment. A cautious Fed could amplify the ongoing tech-led equity correction, while sticky UK inflation complicates the global easing narrative. Political noise around the Fed adds an additional layer of uncertainty at a time when investors are searching for clarity on the policy path.

Prepared by Nour Hammoury, Chief Market Analyst at SquaredFinancial

Nour is an investor, independent market strategist, and financial advisor. He holds a BA in Finance and Banking Science from Al-Ahliyya Amman University and a CFTe in Economics from the International Federation of Technical Analysts. He has more than 15 years of experience in forex, stocks, and global economic developments, as well as central bank policies and intermarket analysis. He appears regularly on major international TV networks, such as BBC, Al-Jazeera, Al Hurra, CNBC, and Bloomberg, holding open discussions and sharing insights and readings of the markets and trends.

Disclaimer

This is a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. The information contained herein does not constitute a personal recommendation and does not consider your personal investment objectives, investment strategies, financial situation or needs. Squared Financial makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on a recommendation, forecast, or other information supplied by Squared Financial.