Cautious optimism fuels markets amid central bank cues and crypto momentum

Global markets entered Friday on a cautiously optimistic note, buoyed by favorable earnings, legislative clarity on digital assets, and shifting central bank expectations. While equities continue their steady climb, underlying themes of monetary policy uncertainty and regulatory transformation are shaping market sentiment.

Equities Extend Gains on Strong Earnings and Economic Data

The global equity rally extended into Asia, with the MSCI Asia Pacific Index gaining 0.4%. Strength in semiconductor and AI-linked stocks helped lift sentiment, with Taiwan Semiconductor Manufacturing Co. reaching a new record high in Taipei following a positive earnings outlook.

In the US, stock index futures rose after the S&P 500 and Nasdaq 100 set fresh closing highs. Investor confidence was supported by solid retail sales data and falling jobless claims, highlighting economic resilience. However, political volatility remains in the backdrop, with President Trump’s public criticism of the Federal Reserve and talk of replacing Chairman Powell adding uncertainty to the Fed’s trajectory.

Netflix delivered another positive earnings surprise, reporting Q2 revenue of $11.1 billion and earnings of $7.19 per share. The streaming giant raised its full-year sales and margin forecasts, supported by strong content releases and a favorable dollar. Despite a minor post-earnings pullback in shares, the company now boasts a market cap exceeding $500 billion — larger than several legacy media giants combined.

Crypto Industry Scores Landmark Victory

In a historic development for the digital asset space, US Congress passed the first federal legislation regulating stablecoins. The bill, backed by broad bipartisan support and championed by President Trump, introduces regulatory oversight for dollar-linked tokens, potentially unlocking significant growth in crypto payments and adoption.

This legislation is seen as a turning point for the crypto industry, offering both regulatory legitimacy and market confidence. Major players like Circle and Coinbase are expected to benefit. The news helped lift cryptocurrencies, with Bitcoin hovering near its all-time high around $123,000 and Ether surging 5% to $3,596.98.

The passage of this bill comes alongside a broader push to define the regulatory framework for digital assets in the US, with implications for banks, payment providers, and tech companies eyeing stablecoin issuance.

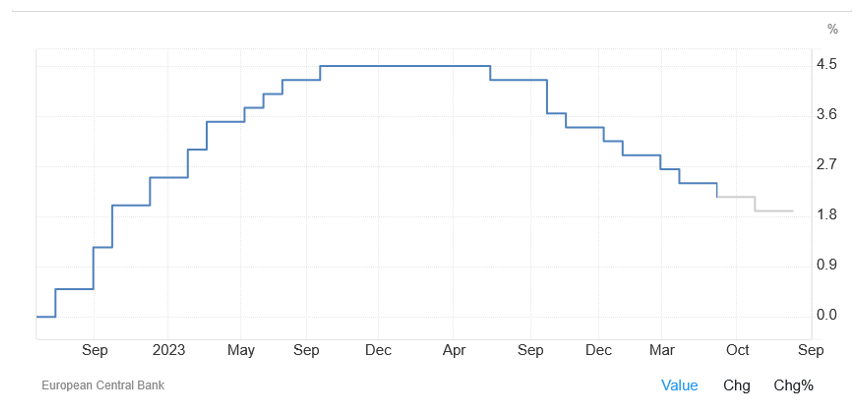

ECB Remains Cautious as Rate Path Diverges

In Europe, the ECB appears in no rush to deliver additional rate cuts. While markets still price in one more reduction by year-end — most likely in September — policymakers are divided on the timing and necessity. A Bloomberg survey shows a growing acceptance that the central bank could pause until December without sending a signal that easing is over.

Concerns about external risks, including trade tensions with the US and a strengthening euro, are tempering the case for near-term action. Officials are wary of fueling speculation about the policy floor or triggering volatility. The ECB’s next move is likely to hinge on economic data and developments in EU-US trade talks, especially as President Trump threatens new tariffs.

Euro strength remains a key concern, with the currency gaining nearly 12% year-to-date against the dollar. Should it approach $1.20, ECB officials believe it could begin to weigh on growth and inflation. Market participants remain split on whether disinflation or inflation overshoot risks dominate the outlook.

Looking Ahead

Markets remain sensitive to central bank signals, with upcoming policy meetings from the ECB and the Fed under scrutiny. Corporate earnings and macroeconomic indicators will continue to drive short-term momentum. Meanwhile, regulatory shifts in crypto and trade dynamics between the US and Europe could introduce fresh volatility.

Investors are advised to monitor currency movements and yield curves closely, particularly as central banks balance domestic inflation pressures against geopolitical and trade uncertainties.

Prepared by Nour Hammoury, Chief Market Strategist at SquaredFinancial

Nour is an investor, independent market strategist, and financial advisor. He holds a BA in Finance and Banking Science from Al-Ahliyya Amman University and a CFTe in Economics from the International Federation of Technical Analysts. He has more than 15 years of experience in forex, stocks, and global economic developments, as well as central bank policies and intermarket analysis. He appears regularly on major international TV networks, such as BBC, Al-Jazeera, Al Hurra, CNBC, and Bloomberg, holding open discussions and sharing insights and readings of the markets and trends.

Disclaimer

This is a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. The information contained herein does not constitute a personal recommendation and does not consider your personal investment objectives, investment strategies, financial situation or needs. Squared Financial makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on a recommendation, forecast, or other information supplied by Squared Financial.