Powell’s Jackson Hole playbook

Markets are marking time ahead of Chair Jerome Powell’s keynote at Jackson Hole today (10:00 a.m. New York / 6:00 p.m. Dubai). Positioning has shifted from aggressive easing hopes to a more data-anchored path as investors look for two things from Powell: (1) how he frames the prospect of a near-term cut without denting the Fed’s independence, and (2) what the five-year policy framework review implies for inflation control and the employment mandate into 2026.

United States: Jackson Hole & policy setup (Lead)

- What to listen for. Expect Powell to keep September “live” while stressing decisions will be guided by incoming labor and inflation data. He is also poised to set today’s guidance within the broader, quinquennial review of the Fed’s strategy—useful context given the unusual setup of easing even as year-over-year inflation has firmed. The speech’s framing also helps reinforce central-bank independence amid political noise.

- Market odds have cooled. Yesterday, swaps implied roughly an 80% chance of a quarter-point September cut; this morning, pricing eased toward ~70% with fewer than two moves for the year as investors brace for a measured tone.

- Rates backdrop. The 10-year Treasury yield is hovering near ~4.33% after a modest pullback Thursday; the dollar is flat. Equities have stabilized after a five-day slide, but breadth remains tentative into the speech.

Trading lens:

- A data-dependent message that keeps September open but non-committal likely favors range trading in duration, quality large caps, and carry in IG credit.

- A clear dovish tilt (emphasizing labor softness over sticky prices) would steepen the curve and support rate sensitives (housing, small caps).

- A hawkish hold (inflation vigilance first) risks a front-end bear flattening, a stronger USD, and further factor rotation away from long-duration tech.

US equities: Positioning into the speech

After a tech-led drawdown earlier in the week, S&P 500 futures have steadied and the Nasdaq 100 is little changed. The message is clear: investors want Powell’s blueprint before adding risk. The earlier selloff reflects concern that the AI-led rally ran ahead of policy risk; today’s tone will set the near-term path.

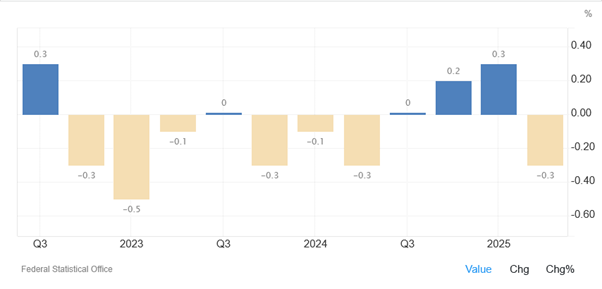

Europe: Germany’s growth hit & transatlantic trade update

- Germany: Q2 GDP was revised down to -0.3% q/q as earlier front-loading of exports to the US unwound and investment sagged. With tariffs biting and domestic frictions (red tape, energy costs) still present, stagnation risks persist into Q3, even as PMIs hint at manufacturing’s slump nearing an end.

- EU–US trade framework: Washington and Brussels outlined steps to operationalize their pact, including conditional US reductions of auto tariffs to 15% once the EU advances legislation to lower its own industrial-goods levies. The statement also sketches quota-based relief for certain metals, commitments on digital trade (no network-usage fees), and EU flexibility on carbon-border rules—plus significant cross-investment and procurement ambitions (defense and AI chips). These terms shape medium-term European industry and US inflation pass-through.

Global crosscurrents to watch

- Rates & FX snapshot: Equities in Europe are modestly higher; S&P 500 futures are marginally green. The 10-year UST sits near ~4.33%. The euro is steady around the mid-1.15s; USD/JPY trades near the high-148s. Gold hovers near ~$3,330/oz; Brent is little changed. Bitcoin is around ~$113k. (Levels rounded; see wrap details.)

- Activity pulse: Earlier in the week, euro-area PMIs quickened to a 15-month high as manufacturing edged out of a three-year downturn—helpful for sentiment but not yet a regime shift. US PMIs, jobless claims, and housing data round out the near-term macro picture feeding into the Fed’s September call.

Scenarios for Powell (Today)

- “Framework-first” reassurance (base case): Powell underscores the five-year policy review, stresses dual-mandate balance, and says September depends on data. Markets likely read this as incrementally dovish but patient, supporting risk modestly and anchoring front-end rates.

- “Labor over prices” tilt: Emphasis on labor softness and “asymmetric” risks lifts cut odds for September; curve steepens, USD eases, and cyclicals/small caps

- “Inflation vigilance” tilt: Powell highlights sticky components and uncertainty around tariffs/second-round effects; front-end sells off, USD firms, and long-duration equities

What’s next (near-term watchlist)

- Today: Powell at Jackson Hole; market internals/positioning into the close.

- This week’s data: US PMIs, jobless claims, and housing indicators shaping the September baseline.

- Europe: Germany’s follow-through data and any new details on EU–US trade implementation, especially autos/metals sequencing.

Powell’s task is to keep optionality while guiding a market that has already faded aggressive easing bets. A framework-anchored, data-dependent message is the cleanest way to balance independence with flexibility—supportive for risk, but not a green light for re-levering until the next labor and inflation prints land.

Prepared by Nour Hammoury, Chief Market Analyst at SquaredFinancial

Nour is an investor, independent market strategist, and financial advisor. He holds a BA in Finance and Banking Science from Al-Ahliyya Amman University and a CFTe in Economics from the International Federation of Technical Analysts. He has more than 15 years of experience in forex, stocks, and global economic developments, as well as central bank policies and intermarket analysis. He appears regularly on major international TV networks, such as BBC, Al-Jazeera, Al Hurra, CNBC, and Bloomberg, holding open discussions and sharing insights and readings of the markets and trends.

Disclaimer

This is a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. The information contained herein does not constitute a personal recommendation and does not consider your personal investment objectives, investment strategies, financial situation or needs. Squared Financial makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on a recommendation, forecast, or other information supplied by Squared Financial.